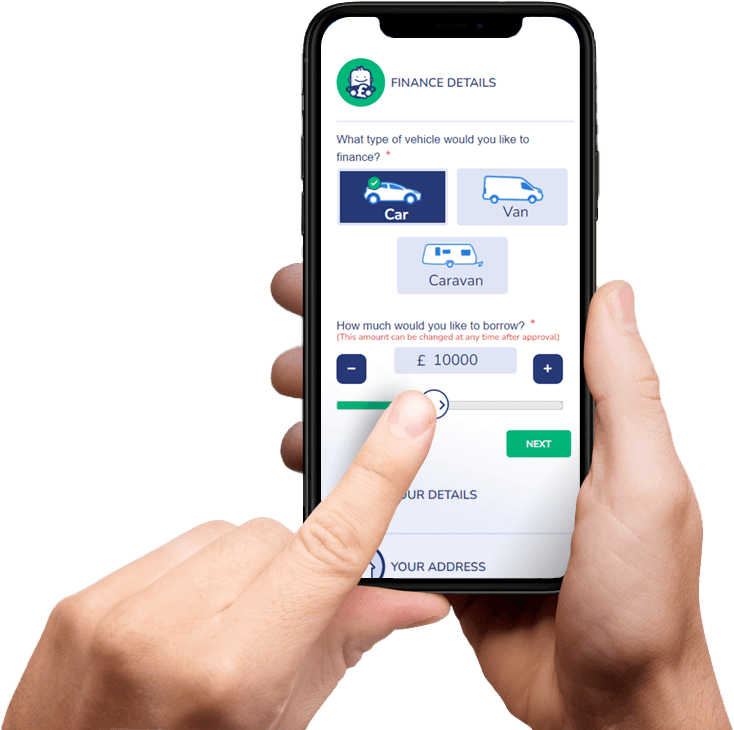

Complete our Simple Application Form and we will review your application. We aim to get you Approved in less than 1 hour with no impact on your credit score.

Bad Credit Car Finance

We aim to get you Approved in less than 1 hour with no impact on your credit score.

Once Approved, you can start looking for your new vehicle or your Dedicated Advisor will be on hand to help you search.

Once Approved, you can start looking for your new vehicle.

Your Dedicated Advisor will assist you with the paperwork and ensure the funds are paid to the dealership swiftly so you can collect your new vehicle ASAP.

Each month we approve around £35 Million worth of vehicle finance applications and many of these customers have a less than perfect credit history.

As a Specialist Finance Broker, we help thousands of customers each year who are turned down by high street lenders. Many people who apply do not believe they will be approved, yet we are still able to offer them competitive finance deals with Zero Deposit and No Admin Fees.

Our car finance products are based on your overall credit profile and not just on your previous financial history. We have a large panel of lenders and can help people with all types of credit profiles. The finance deal offered will be subject to your individual credit status and circumstances.

Having a bad credit history can be caused by many unfortunate events like losing a job, falling ill, a relationship breakdown or a failed business. It can consist of things as simple as late payments on a mobile phone or utility bill but also more serious things like CCJ’s, Defaults, Arrears, Bankruptcy or IVA’s, Unfortunately, once you have a bad credit rating it will be registered on your credit file for at least 6 years

For many people, it can be difficult to be approved by normal high street lenders once they have any of these issues registered against their credit file. They will be deemed riskier as they have a less than perfect track record compared to people who have never experienced any financial difficulty. The good news is at Midland Credit, we have many specialist lenders who are used to helping in these circumstances.

It is important to understand, there are many options available by using Midland Credit. People with very minor issues will usually be offered better rates than people with more severe credit issues. Each application is looked at individually and it is not a case of one rate for everybody. We will offer you the best deal from our panel of lenders.

Whilst there is no such thing as Guaranteed Car Finance, we are currently accepting two out of three applications that we receive and have one of the highest approval rates in the Vehicle Finance industry. If you have been previously refused for Car Finance, then look no further. With our help, you could be driving away in your new vehicle in next to no time.

We have a friendly team who will deal with your application professionally and not judge you on your financial past, so if you have experienced any financial difficulty over the years, please do not let this stop you from completing an application as everyone is considered with us.

We can finance both car & commercial vehicles, with most makes and models accepted. Once approved, you will be assigned a Dedicated Finance Advisor who will be on hand throughout the whole process to help you find a suitable vehicle.

You can complete our Simple Application Form or if you would prefer, you can apply over the phone with one of our friendly advisors. Either way, we aim to give you great service and a decision within the hour without any impact on your credit score.

It really is an easy process, so why not complete our Simple Application Form or call us on 03339 000 000 to apply and you could be driving your new vehicle in just a couple of days.

Don’t just take our word for it, we currently have over 6,000 5 Star reviews on Trustpilot and growing.

All circumstances are considered. Whether you are employed, self-employed, retired or receive some of your income through benefit payments, as long as your monthly income after tax is £1,000 or more, we have lenders that will consider your application.

Some lenders in our panel, are also able to assist customers who have a poor credit history, are currently in an IVA or have previously been bankrupt.

All circumstances are considered. Whether you are employed, self-employed, retired or receive some of your income through benefit payments, as long as your monthly income after tax is £1,000 or more, we have lenders that will consider your application.

Some lenders in our panel, are also able to assist customers who have a poor credit history, are currently in an IVA or have previously been bankrupt.

When applying for finance, the lenders that we work with conduct a soft credit search, which will only be visible to you, but not other finance providers. The good news is that these searches will not affect your credit score.

We work with lenders that can offer finance between £3,000 and £50,000. Your credit limit is determined by the lender with no need to provide income proofs in most cases and this will be confirmed by your dedicated finance advisor.

In almost all cases, a deposit is not required to finance a vehicle, however, a deposit or part exchange can be used if you want to reduce the amount that you borrow and your monthly payments.

Midland Credit are a specialist vehicle finance broker and use a panel of lenders with products to suit all credit circumstances. This does not mean that credit is guaranteed, although, we have one of the highest approval rates in the motor finance market.

We can provide finance for vehicles from thousands of licenced dealerships in the UK and Northern Ireland. We will, of course, check that the dealership is reputable before you proceed so that you have a smooth buying experience.

Midland Credit does not charge any fees for arranging your finance as our service is free of charge. Our income is generated through a commission that we receive from the lender when a finance agreement is taken out.

The lenders that we work with offer finance on a Hire Purchase or Conditional Sale agreement where the whole cost of the car is split across a series of fixed monthly payments, typically spread over two to five years. You will own the vehicle as soon as you’ve made the final payment at the end of the finance agreement.

Borrowing £7,000 over 5 years with a representative APR of 26.9% (Fixed) and a deposit of £0.00

the monthly payment would be £201.62 per month, with a total cost of credit of £5,097.41 and a total amount payable of £12,097.41